File Photo

More than 8 in 10 people working from home could be missing out on up to €100 per year by not claiming 'Work from Home' tax relief.

This is according to the latest Taxback.com survey that sought to understand the sharp under-utilisation of the relief amongst those who work from home.

Taxback.com advise that remote workers are entitled to a tax-free payment of €3.20 per day from their employer to cover the additional costs of their utility and broadband bills.

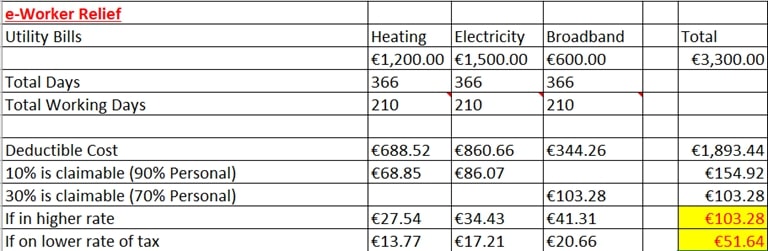

For those whose employers have not been in a position to make this payment, a claim on 'Remote Working' relief allows people to claim back a portion of their utility and broadband bills for each day they work from home. Specifically, 10% of the cost of electricity and heat incurred and 30% of the cost of broadband incurred.

These costs are apportioned based on the number of days that you worked at home during the year.

Barry Cahill of Taxback.com stated that according to a paper on working from home released in 2021, "875,000 people are estimated as having been remote workers. However, just 90,000 people made a claim for tax relief for working from home expenses as of May this year – just 10% of those who are eligible!

"We have been advising any clients working from home to collate their bills and claim this relief. Anyone not doing so is missing out on ‘free money’, and while the amounts may be small, it’s hard to understand why anyone would not want this money in their pocket instead of leaving it with the taxman."

Most people did not know that relief can be claimed on their share of the bills. In fact, almost half of those who took the survey believe the relief isn’t available to those in a house share and/or if their names are not on the bills in question. This is untrue," Mr Cahill continues.

"If you share your bills with someone else, the cost is divided between you, based on the amount paid by each person. With thousands of people in the working from home brigade sharing their accommodation with others, eligibility for this relief for people in this scenario is likely to be commonplace.

"Say, for example, someone started working from home full-time at the start of the pandemic (March 2020) and remained at home working full-time for the rest of 2020. They would have worked from home for 210 days (42 weeks X 5 days). Their utility bills and broadband bills would have to be apportioned out so that they could decipher their deductible costs.

[How e-Worker Relief is calculated / Image: Taxback.com]

"We would really urge remote workers to utilise this relief. Some simply don’t know about it, others might not fully understand how it works, and more again may believe it’s too much hassle to claim. But we want to dispel these inaccuracies and myths. Simply put – tax refunds like this are money for jam as the saying goes, and what we have found is that claiming tax back is habitual – so those who don’t claim now are likely to miss out on other reliefs too.

"With remote working continuing to proliferate the Irish workforce, we must do more in 2022 to call people to action and explain how they could avail of the relief in just a few easy steps. While the language around these reliefs can sometimes be complex to understand, the actual process of claiming is very easy. We believe that 2023 will see a significant increase in the numbers claiming as many will be able to do so for 2020, 2021 and 2022 altogether."

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.